XM was found in 2009. The company grew fast and currently has over 450 employees in over 120 offices. The company has over 2 400 000 clients from 196 counties. XM supports over 30 languages and it is suitable for clients all over the world. There is also a big amount of different type of analysis and another type of resources which could be used from clients with a different type of knowledge.

| Open Account | Support | Withdrawal | Deposit | Execution | Spread | Overal rating | |

|---|---|---|---|---|---|---|---|

XM is a good broker for beginners because it offers a micro account where traders can learn from their mistakes without the need to cost a fortune, but also good for traders with more experience because it offers competitive spreads and a good platform with an option for trading with robots.

XM offers over 1000 trading instruments in 6 different asset classes. The instrument list in Forex contains 55 currency pairs including major, minor, and exotic pairs. The clients could trade stocks from a big range of markets includes UK, USA, France, Germany, Netherlands, Spain, Switzerland, Belgium, Italy, Greece, Portugal, Sweden, Finland, Norway, Austria, Russia, and Australia. Commodities include eight instruments like Wheat, Cocoa, Sugar, Corn, and others. The list of equity indices contains 18 of the biggest world indices. The clients of the broker could also trade GOLD, SILVER, Oil, and Natural gas.

XM offers three types of account – Micro account, Standard account, and XM Zero account. The Micro account is suitable for new traders that just start with forex and want to get deeper knowledge or just understand what the product is. On the other hand, the XM Zero account is an account that has been designed for experienced traders who are searching for more competitive conditions for trading. You could see a comparison between the different accounts in the table below.

| Micro Account | Standard account | XM Zero account | |

| Base Currency Options | USD, EUR, GBP, JPY, CHF,AUD, HUF, PLN, RUB, SGD, ZAR | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR | USD, EUR, JPY |

| Contract Size | 1 Lot = 1,000 | 1 Lot = 100,000 | 1 Lot = 100,000 |

| Spread on all majors | As Low as 1 Pip | As Low as 1 Pip | As Low as 0 Pips |

| Commission | NO | NO | YES |

| Maximum open/pending orders per client | 200 Positions | 200 Positions | 200 Positions |

| Minimum trade volume | 0.01 Lots (MT4) | 0.01 Lots | 0.01 Lots |

| Lot restriction per ticket | 100 Lots | 50 Lots | 50 Lots |

| Islamic Account | Optional | Optional | Optional |

| Minimum Deposit | 5$ | 5$ | 100$ |

The minimum deposit of 5$ allows you to open an account without the need to deposit a big amount of money. The option for a micro account is a great opportunity to test in real environments different strategies and expert advisors. This is also a great way to see how the broker works in realtime, what is the execution, what is the slippage, what are the real spreads. Also, this allows you to check what is the support, deposit withdrawal process, etc.

There is also an option for Islamic accounts so the Islamic traders can trade without swaps.

Many brokers have a limitation on the opened position, but the limit of the XM of 200 opened positions is pretty high. This number may seem not important but in many cases, micro accounts are used for averaging strategies, and this requires a lot of positions. When there is a need for even more positions for another instrument you and 50-100 are not enough. 200 is big enough limitation to trade more than enough instruments.

Since our goal is to make the most detailed XM review we conducted several tests of the commercial conditions.The costs of trading are one of the most important requirements for successful trading. The spread is the most most important cost for active traders. We did deep and comprehensive research in order to measure the spread (the difference between the bid and the Ask price). Another important indicator is execution. As the quotes from forex brokers are indicative, it is important to measure the slippage (the difference between the requested and the executed price).

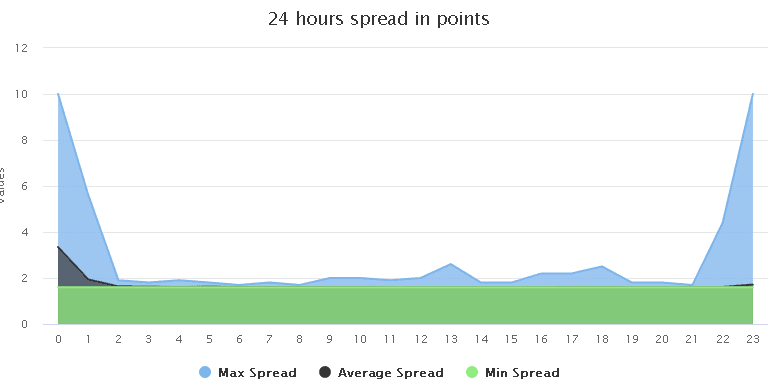

In the chart below you could see the minimum, the maximum, and the average spread for EURUSD (the most traded pair) in XM. The time zone is the server time of XM (GMT +2). You could see that the minimum spread stays stable at 1.6 pips. The average spread is almost equal to the minimum spread. The maximum spread is not far from the average spread. There is one exception and this is the hours around rollover. Normally the average and the maximum spreads at that time are higher.

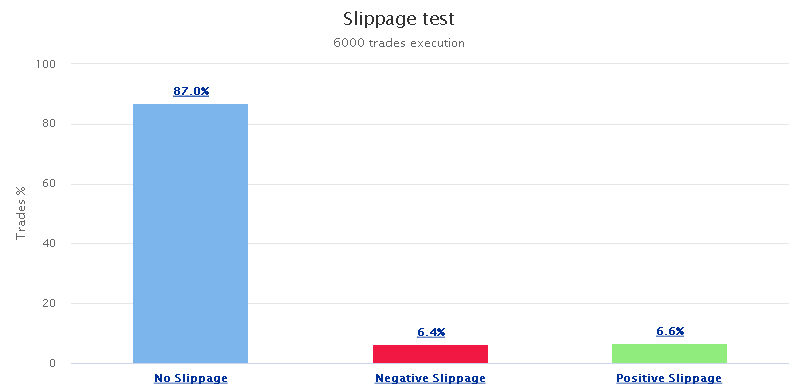

We made also a slippage test. We executed to the broker by over 6000 trades. The purpose of that test is to show what is the execution quality, and what slippage should traders expect from XM. It is important to mention that the trades are executed in equal intervals during the day, because we want to show what happens during the regular trading time, not in high volatility during news or other major events. All the trades are executed at the market.

After 6000 executed traders we get 5259 trades with no slippage which is the 87% of all executed trades. We can also see that the positive slippage (slippage in our direction) is slightly higher than the negative slippage and this is in the trader's favor.

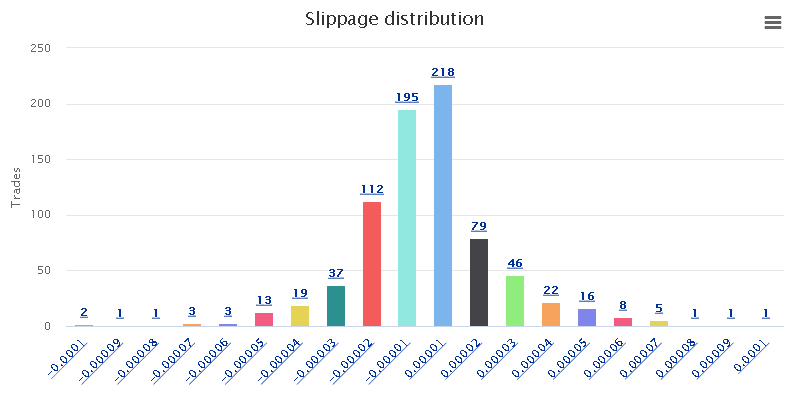

As expected the distribution of XM slippage shows that the majority of the slippages are concentrated between +0.5 pips and -0.5 pips with much higher values at -0.1 and 0.1 pips. The maximum slippages were -1 pips and +1 pips. The average positive slippage was 0.200252 and the average negative slippage was -0.19352 which again is in slight favor of the trader.

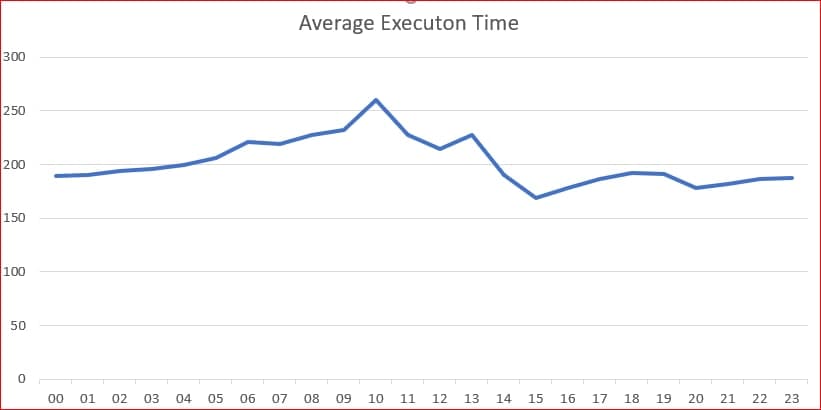

We found that there is consistent small increasing in the execution times from 5 AM during the whole EU session. It is reaching its peak at 10 and it is getting lower towards the open of the US session. The difference is just around 100ms, which is not significant.

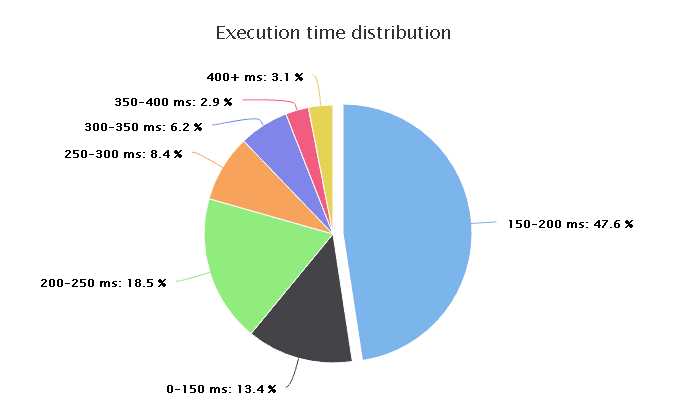

During the execution test, we also monitored the execution time. Of course, that information is relative and depends on your location, data center, etc. The important thing here is to see if there any significant delay over 500ms and if there is any pattern during the hours in the day. We have performed 6000 trades and the average execution time was 203. The maximum and the minimum execution times were 94 and 869.

| Currency Pair | Minimum Price Fluctuation | Minimum Spread | Average Spreads* | Margin Percentage | Long Swap | Short Swap |

|---|---|---|---|---|---|---|

| AUDCAD | 0.00001 | 0.00028 | 0.0003 | 5 % | -4.57 | -3.25 |

| AUDCHF | 0.00001 | 0.00027 | 0.0003 | 5 % | -1.44 | -3.94 |

| AUDJPY | 0.001 | 0.032 | 0.033 | 5 % | -2.62 | -3.52 |

| AUDUSD | 0.00001 | 0.00016 | 0.00019 | 5 % | -2.5 | -1.39 |

| CADCHF | 0.00001 | 0.00035 | 0.00037 | 3.33 % | -1.03 | -4.63 |

| CHFJPY | 0.001 | 0.028 | 0.033 | 3.33 % | -6.69 | -2.65 |

| EURAUD | 0.00001 | 0.00027 | 0.0003 | 5 % | -8.87 | -4.57 |

| EURCHF | 0.00001 | 0.00023 | 0.00027 | 3.33 % | -3.67 | -5.07 |

| EURGBP | 0.00001 | 0.00018 | 0.0002 | 3.33 % | -4.05 | -0.95 |

| EURJPY | 0.001 | 0.021 | 0.023 | 3.33 % | -4.53 | -2.23 |

| EURNZD | 0.00001 | 0.00039 | 0.0004 | 5 % | -11.12 | -3.22 |

| EURUSD | 0.00001 | 0.00016 | 0.00017 | 3.33 % | -5.58 | -0.78 |

| GBPAUD | 0.00001 | 0.00036 | 0.00043 | 5 % | -6.75 | -8.05 |

| GBPCAD | 0.00001 | 0.00043 | 0.00056 | 3.33 % | -7.45 | -6.55 |

| GBPCHF | 0.00001 | 0.0003 | 0.00046 | 3.33 % | -2.27 | -7.47 |

| GBPJPY | 0.001 | 0.032 | 0.036 | 3.33 % | -2.87 | -4.47 |

| GBPNZD | 0.00001 | 0.00062 | 0.0007 | 5 % | -8.54 | -7.14 |

| GBPSGD | 0.00001 | 0.00276 | 0.0031 | 5 % | -15.07 | -11.57 |

| GBPUSD | 0.00001 | 0.0002 | 0.00024 | 3.33 % | -4.06 | -2.76 |

| NZDCAD | 0.00001 | 0.00038 | 0.00041 | 5 % | -3.61 | -3.71 |

| NZDUSD | 0.00001 | 0.00025 | 0.00027 | 5 % | -1.83 | -1.73 |

| USDCAD | 0.00001 | 0.0002 | 0.00022 | 3.33 % | -3.64 | -3.8 |

| USDCHF | 0.00001 | 0.00019 | 0.00021 | 3.33 % | -0.03 | -5.03 |

| USDHUF | 0.001 | 0.28 | 0.51 | 5 % | -24.05 | -21.05 |

| USDJPY | 0.001 | 0.015 | 0.016 | 3.33 % | -1.75 | -4.15 |

| USDNOK | 0.00001 | 0.0067 | 0.0087 | 5 % | -66.45 | -79.85 |

| USDPLN | 0.00001 | 0.004 | 0.0052 | 5 % | -28.59 | -30.59 |

| USDRUB | 0.0001 | 0.4155 | 0.437 | 5 % | -172.59 | -24.59 |

| USDTRY | 0.00001 | 0.00641 | 0.0093 | 5 % | -175.51 | -12.11 |

| USDZAR | 0.0001 | 0.0112 | 0.014 | 5 % | -30.65 | 5.39 |

Except Forex, XM offers a rich amount of different commodities. The exact instruments and conditions you could see in the table below.

| Symbol | Description | Minimum Price Fluctuation | Minimum Spread | Min/Max Trade Size | Margin Percentage |

|---|---|---|---|---|---|

| COCOA | US Cocoa | 1.00000 | 15 | 1/500 | 10 % |

| COFFE | US Coffee | 0.00010 | 0.008 | 1/80 | 10 % |

| CORN | US Corn | 0.00010 | 0.0275 | 1/500 | 10 % |

| COTTO | US Cotton No. 2 | 0.00010 | 0.0047 | 1/100 | 10 % |

| HGCOP | High Grade Copper | 0.00010 | 0.0077 | 1/200 | 10 % |

| SBEAN | US Soybeans | 0.00010 | 0.0185 | 1/250 | 10 % |

| SUGAR | US Sugar No. 11 | 0.00010 | 0.0009 | 1/500 | 10 % |

| WHEAT | US Wheat | 0.00010 | 0.025 | 1/500 | 10 % |

Other offered instrument type is Metals. XM offers the two top traded metals - Gold and Silver. Details about the conditions for trading are listed below.

| Currency Pair | Minimum Price Fluctuation | Minimum Spread | Average Spread | Margin Percentage | Long Swap | Short Swap | Value of 1 lot |

|---|---|---|---|---|---|---|---|

| GOLD | 0.01 | 0.3 | 0.35 | 5 % | -10.1 | -5.47 | 100 oz |

| SILVER | 0.001 | 0.03 | 0.035 | 10 % | -1.18 | -0.68 | 5000 oz |

All the offered instruments are with very competitive spread swap and execution. Such a trading environment can improve your profit significantly.

The clients could choose between Meta Trader 4 and Meta Trader 5. XM also offers different types of these platforms – the clients could access them from Desktop (Windows and Mac), Mobile (Android and iPhone), and Web Trader.

MetaTrader is offered by the best forex broker. It offers not only a user-friendly interface for beginners but also very powerful tools for advanced traders. There is a built-in interface to create your own trading robots and complex indicators. There is also a huge forum supported by the MetaQuotes and there you can find countless custom indicators, expert advisors and scripts.

When you create your own strategy (or download from someone else) you can use the powerful MetaTrader backtester to see how that strategy has performed during the years.

There is also an integrated option for VPS for your trading robots, which you can operate directly from the platform. You can be sure that they are up and running without having to face complex technologies.

The social trading in MT brings up together investors and traders. Bot need just the platform and can subscribe to follow or just create their own signal. There is a huge list of available signals with very sophisticated statistics. There are many things we can se for Metatrader in this Pepperstone review, but the platform itself is not the main focus.

XM offers his services to clients from three main jurisdictions. In Cyprus, the company is regulated by CySEC under license number 120/10. In Australia, XM is regulated by the Australian Financial Services License by ASIC (number 443670). And in Belize XM is licensed by IFSC under license number IFSC/60/354/TS/19.

XM offers over 25 deposit and withdrawal methods. They include Credit Cards, Skrill, Neteller, Union Pay, Sofort Banking, CashU, and others.

| Headquarters | New York, USA |

| Regulators | CySEC, ASIC, IFSC |

| Trading Products | Forex, Comodities, Indices, Metals |

| Demo Account | Yes |

| EURUSD Spread | 1.6 Points |

| Trading platforms | MT4, MT5 |

| Deposit methods | Credit Cards, Skrill, Neteller, Union Pay, Sofort Banking, CashU |

| Minium deposit | 5$ |

| Micro accounts | Yes |

| Swaps | Fixed |

| Rating | 9.4/10 |

| More Info | XM |

As conlcusion of this XM review we can say that the broker offers a high quality service. The clients of the company can trade over 1000 instruments in three main jurisdictions, and can receive support in 30 languages. The offered platformes are very competitive. XM supports 25 different deposit methods. So in general this is regulated broker with very good competitive conditions.

Miroslav Georgiev is Senior Risk Executive with 20+ years of professional wide-ranging experience in multinational forex companies. Take part in Global setup and development of Forex and CFD being an active part of the Business Team. Build and manage Risk management departments and teams.

Looking for an independent and professional Forex brokers review? Our researches will help you find a broker supporting all financial instruments you may need. It will also help you choose the best trading platform for your manual or automated trading.

Disclaimer: Trading Forex (foreign exchange) or CFDs (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. Please note that FxBrokersRanking.com do not provide any kind of financial advices or recommendations.

Advertiser Disclosure: FxBrokersRanking.com is free for everyone, but earns a commission from some of the brokers. We get a commission, with no additional cost to you.