Alpari is a forex broker with more than 20 years of history. The company behind the brand is Exinity Limited located in the Republic of Mauritius. The company is regulated by the Financial Services Commission (FSC) of the Republic of Mauritius.

| Open Account | Support | Withdrawal | Deposit | Execution | Spread | Overal rating | |

|---|---|---|---|---|---|---|---|

The available accounts are Nano, Standard MT4/MT5, ECN MT4/MT5 or PRO ECN/MT4. The Nano account is a cent account for Metatrader 4. It offers 33 currency pairs plus Gold and Silver. For the leverage, the maximum is 1:500. The Standard account is offered for Metatrader4 and Metatrader 5. It offers the same trading instruments, but you can have leverage up to 1:1000. Another difference is that with the standard account you can have 500 trades opened at the same time, compared to 25 only in the Nano account. The average spread for the standard account is 1.1 points.

For the ECN MT4, you can achieve an average spread for EURUSD to 0.9 and for Pro ECN/MT4 and ECNMT5 you get average spreads as low as 0.7 points.

| Account type | Platform | Leverage | Spread | CFD | Deposit |

| Nano MT4 | MetaTrader 4 | 1:500 | 1.1 | NO | 0 |

| Standard MT4 | MetaTrader 4 | 1:1000 | 1.1 | NO | 20 |

| Standard MT5 | MetaTrader 5 | 1:1000 | 1.1 | NO | 100 |

| ECN MT4 | MetaTrader 4 | 1:1000 | 0.9 | 18 | 300 |

| PRO ECN MT4 | MetaTrader 4 | 1:1000 | 0.7 | 18 | 500 |

| ECN MT5 | MetaTrader 5 | 1:1000 | 0.7 | 18 | 500 |

Every client registered in Alpari also takes part in their cashback system. Every time you deposit, invest or trade you receive bonus points. This points later, you can convert to money or to return some of the trading costs. The points you receive depends on your initial deposit. The maximum is 50k$ and you will receive 1.3 times more points compared to a 200$ account.

Depending on the account type you choose, you can have up to 46 forex pairs, two metals (gold and silver) and up to 18 CFD. Here are some of the most popular forex pairs with their spread, point and swap for long and short.

| Instrument | Min Spread | Point | Swap Short | Swap Long |

| AUDCHF Australian Dollar / Swiss Franc | 0.2 | 0.00001 | -0.7000 | 0.1200 |

| AUDJPY Australian Dollar / Japanese Yen | 0.2 | 0.001 | -0.6300 | 0.0500 |

| AUDNZD Australian Dollar / New Zealand Dollar | 0.4 | 0.00001 | -0.2900 | -0.4000 |

| AUDUSD Australian Dollar / US Dollar | 0.4 | 0.00001 | 0.0100 | -0.4700 |

| CADCHF Canadian Dollar / Swiss Franc | 0.4 | 0.00001 | -0.9000 | 0.2100 |

| CADJPY Canadian Dollar / Japanese Yen | 0.4 | 0.001 | -0.8500 | 0.1500 |

| CHFJPY Swiss Franc / Japanese Yen | 0.4 | 0.001 | -0.1400 | -0.5500 |

| EURAUD Euro / Australian Dollar | 0.4 | 0.00001 | 0.2000 | -1.3300 |

| EURCAD Euro / Canadian Dollar | 0.4 | 0.00001 | 0.3600 | -1.5300 |

| EURCHF Euro / Swiss Franc | 0.4 | 0.00001 | -0.4600 | -0.1600 |

| EURGBP Euro / Great Britain Pound | 0.4 | 0.00001 | 0.0500 | -0.6000 |

| EURJPY Euro / Japanese Yen | 0.4 | 0.001 | -0.2300 | -0.3900 |

| EURNZD Euro / New Zealand Dollar | 0.6 | 0.00001 | 0.2500 | -1.6500 |

| EURTRY Euro / Turkish Lira | 2.2 | 0.00001 | 31.4300 | -75.2600 |

| EURUSD Euro / US Dollar | 0.2 | 0.00001 | 0.3500 | -1.2600 |

| GBPAUD Great Britain Pound / Australian Dollar | 0.8 | 0.00001 | -0.2700 | -0.8400 |

| GBPCAD Great Britain Pound / Canadian Dollar | 0.8 | 0.00001 | 0.0400 | -1.1100 |

| GBPCHF Great Britain Pound / Swiss Franc | 0.6 | 0.00001 | -1.0500 | 0.1300 |

| GBPJPY Great Britain Pound / Japanese Yen | 0.6 | 0.001 | -0.8700 | 0.0200 |

| GBPNZD Great Britain Pound / New Zealand Dollar | 1 | 0.00001 | -0.2900 | -0.9700 |

| GBPSGD Great Britain Pound / Singapore Dollar | 2.5 | 0.00001 | -0.2100 | -1.2300 |

| GBPUSD Great Britain Pound / US Dollar | 0.4 | 0.00001 | 0.1300 | -0.9700 |

| NZDJPY New Zealand Dollar / Japanese Yen | 0.4 | 0.001 | -0.7700 | 0.0100 |

| NZDUSD New Zealand Dollar / US Dollar | 0.4 | 0.00001 | -0.0300 | -0.4000 |

| USDCAD US Dollar / Canadian Dollar | 0.6 | 0.00001 | -0.4800 | -0.1500 |

| USDCHF US Dollar / Swiss Franc | 0.4 | 0.00001 | -1.2700 | 0.3700 |

| USDJPY US Dollar / Japanese Yen | 0.4 | 0.001 | -1.2100 | 0.3100 |

| Total position volume | Leverage | Floating margin (%) |

| 0–700,000 | 1:1000 | 0.1 |

| 700,001–2,000,000 | 1:500 | 0.2 |

| 2,000,001–7,000,000 | 1:200 | 0.5 |

| 7,000,001–15,000,000 | 1:100 | 1 |

| more than 15,000,000 | 1:25 | 4 |

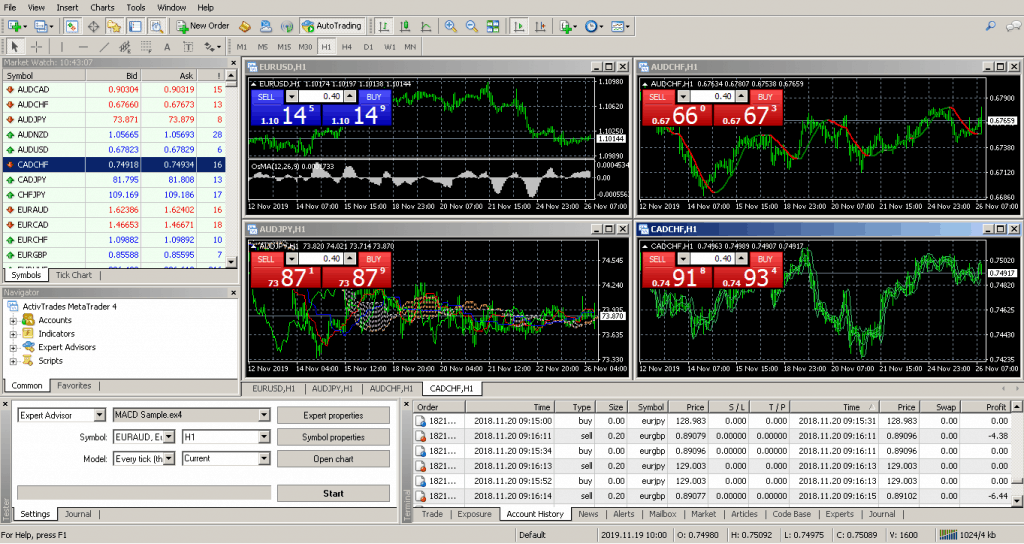

The only trading platform that the broker support is MetaTrader - versions 4 and 5. Metatrader is a proven platform, good for both - manual and automated trading and covers well all the operating system and devices. The downside is that the users who don't like Metatrader have no choice.

MetaTrader 4 and 5 is not a desktop platform only. Of course, the desktop platform is the most powerful one, allowing all the custom features, indicators, expert advisors, build in social trading and more. But there are many versions that cover all the possible devices and environments. There is Metatrader for Web, Android, Ios, MAC.

The Metatrader 5 offers additional features for the traders who use robots for trading. There you have the ability to do huge backtest including a group of computers or hire special servers. This allows very big and complex tests to be executed much faster.

All Metatrader users can take advantage of the build-in VPS service,

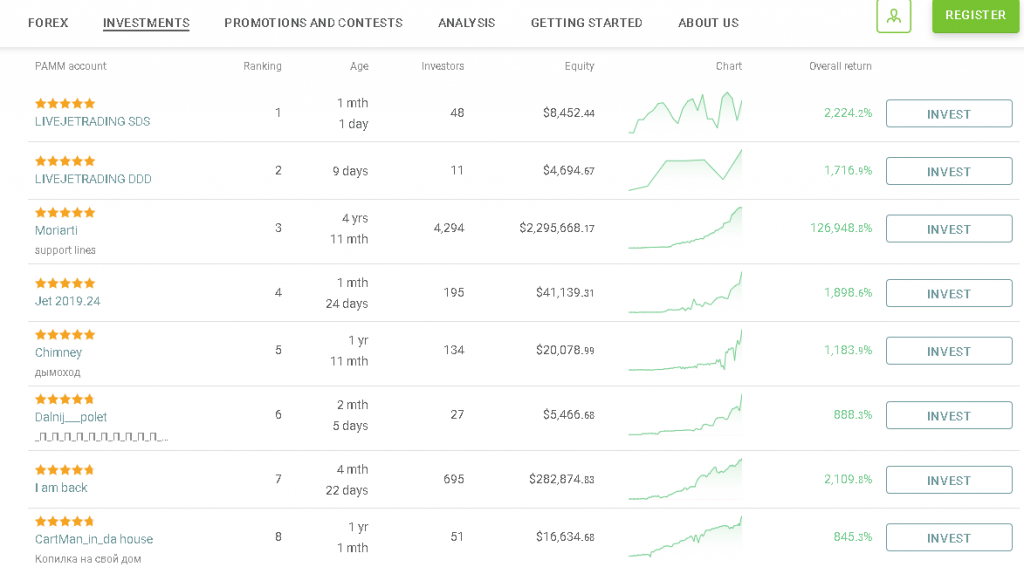

Alpari has developed one of the best social trading platforms in the forex market. Not only you can monitor all the trader's performance in the PAMM section, but you can create complex portfolios to diversify your risk. Of course, this doesn't mean that all PAMM providers are good, but you have a big list to choose with detailed information about any of them. The calculated parameters like Maximum profit, Maximum drawdown, Maximum daily profit, Maximum daily loss, Current drawdown, Current drawdown, Daily return volatility, Recovery factor, Average geometric return, Geometric standard deviation of return, and Average daily profit provide you all you need to know to find the best strategy for you. Of course with all that you have a chart with detailed info for the trader's equity changes during time.

Alpari CopyTrade allow you to copy the trades of certain traders named Strategy Managers. You do not need to be experienced forex trader to can win money from forex trading. Using this service, you could check thousands of Strategy Managers trading history and choose which ones to follow and copy their trades.

Let suppose you invest 1000 USD in certain Strategy Manager and start copy his trades. Strategy Manager gain 500 USD. The system charge 10% of this profit for the Strategy Manager. Moreover, you will gain 450 USD with small efforts from your side. The minimum to participate in this scheme is 100 USD. In the same time, you have full control over your account – you could stop the service at any time when you decide. Additionally, your account is visible only to you and it is fully protected. The update time of the system is just below one minute.

Alpari clients can take advantage of several extra products. The FXSTREET economic calendar allows you to monitor the upcoming news and events on the markets. FxWirePro is one of the recommended by mql4 developers for the best news display feature. You can see the most important news in realtime. Autochartist is a powerful software for analysis and pattern recognition. Its main goal is to predict the future trend direction.

Alpari is a Forex broker who has proven to be reliable and correct over the years. It has very competitive low costs and exceptional social trading features. The Alpari social trading offers one of the best social trading providers. The option to hide the trades allows the participation of much more quality providers.

Miroslav Georgiev is Senior Risk Executive with 20+ years of professional wide-ranging experience in multinational forex companies. Take part in Global setup and development of Forex and CFD being an active part of the Business Team. Build and manage Risk management departments and teams.

Looking for an independent and professional Forex brokers review? Our researches will help you find a broker supporting all financial instruments you may need. It will also help you choose the best trading platform for your manual or automated trading.

Disclaimer: Trading Forex (foreign exchange) or CFDs (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. Please note that FxBrokersRanking.com do not provide any kind of financial advices or recommendations.

Advertiser Disclosure: FxBrokersRanking.com is free for everyone, but earns a commission from some of the brokers. We get a commission, with no additional cost to you.