Tickmill is a forex broker established in 2014 and started his operation in 2015. The company has regulated in several jurisdictions included FCA (Financial Conduct Authority) in the United Kingdom, Cyprus Securities and Exchange Commission (CySEC), Financial Services Authority (FSA) in Seychelles, and Labuan Financial Services Authority (Labuan FSA).

Accounts:

Tickmill generally offers three types of accounts – Pro Account, Classic Account, and VIP Account. The minimum deposit for the first two types of accounts is 100 currency units. The third one does not have a minimum deposit but has minimum Balance in the account – 50 00 currency units. All these types of accounts can be denominated in four different currency – USD, EUR, GBP, and PLN.

Charges and fees:

Tickmill is from the brokers that apply charges and fees lower than the average of the industry. The broker does not have deposit and withdrawal fees. Also, the company does not charge an inactivity fee if you do not use your account. The company has commissions for trading if you use Pro or VIP account (classic account is with zero commissions). Another common cost is SWAP rates. Our comparison shows that the SWAP rates of Tickmill are generally lower than average.

Payment methods:

There is a good choice for deposit and withdrawal methods. The minimum deposit is 100 USD and the minimum withdrawal 25 USD. The currencies for deposits and withdrawals are the same four currencies in which accounts are denominated – USD, EUR, GBP, and PLN. Most of the deposits happen instantly (except Bank Transfer) and for withdrawals, the normal processing time is one working day. The payment methods are: Bank transfer, Visa or Mastercard card, Skrill, Neteller, Dotpay, Paysafe Card, Sofort, Rapid Transfer, and PayPal.

Supported instruments:

Tickmill offers over 60 Forex CFDs, 14 CFDs based on the top world stock indices, oil, metals (gold and silver), and German bonds CFDs.

The leverage for standard retail clients is 30:1 for main pairs and for professional clients and these ones in the company regulated from Labuan FSA could reach up to 500:1

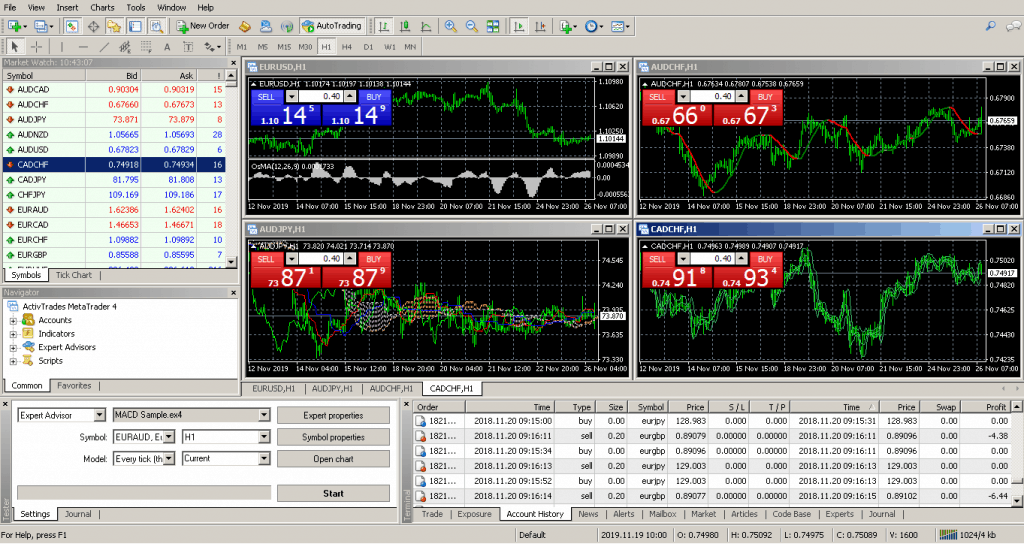

Platforms:

Tickmill’s clients could use MetaTrader 4 to access the market and make their trades. For the clients that prefer web or mobile trading, there is a separate version of the MetaTrader 4 for them.

Conclusion:

Tickmill is a forex and CFD broker with one of the top regulations for forex (FSA). For the clients that prefer higher leverages, the company has also another license. The charges of the broker are generally low. There are a wide set of payment methods and the portfolio of trading instruments is average for the industry. There isn't a variety of platforms, but for most of the traders MetaTrader4, which is the most used forex platform, this should be enough.

Miroslav Georgiev is Senior Risk Executive with 20+ years of professional wide-ranging experience in multinational forex companies. Take part in Global setup and development of Forex and CFD being an active part of the Business Team. Build and manage Risk management departments and teams.

Looking for an independent and professional Forex brokers review? Our researches will help you find a broker supporting all financial instruments you may need. It will also help you choose the best trading platform for your manual or automated trading.

Disclaimer: Trading Forex (foreign exchange) or CFDs (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. Please note that FxBrokersRanking.com do not provide any kind of financial advices or recommendations.

Advertiser Disclosure: FxBrokersRanking.com is free for everyone, but earns a commission from some of the brokers. We get a commission, with no additional cost to you.