SAXO BANK is a danish bank established in 1992. It is considered as one of the safest brokers because it is a bank and banks have many more regulations compared to regular forex companies. Saxo Bank is regulated from more than a dozen international regulators.

There are 3 major account types: Classic, Platinum, and VIP. Every next account tier gives more benefits to the account holder. The Classic account gives only good market conditions, trading platforms, and support. Moving to the next tier will give you 30% lower costs and support in your language. The final VIP account tier gives you everything. Personal manager, Best prices, direct access to SAXO experts, special events indicators.

| Account type | Classic | Platinum | VIP |

| Minimal Funding | USD 10,000 | USD 100,000 | USD 1,000,000 |

Here SAXO bank really shines. You can access everything. You can trade over 182 forex spot pair, 140 forward across majors, over 9000 CFDs, more than 19,000 stocks, and wide range of commodities. You can also trade futures, forex options, listed options, and more than 3,000 exchange-traded funds.

| Instrument | Classic | Platinum | VIP |

|---|---|---|---|

| EUR USD | 0.8 | 0.7 | 0.6 |

| GBP USD | 1.0 | 0.8 | 0.7 |

| EUR JPY | 1.1 | 1.0 | 0.9 |

| USD JPY | 0.8 | 0.7 | 0.6 |

| AUD USD | 0.5 | 0.5 | 0.4 |

| XAU USD | 14.0 | 12.0 | 11.0 |

| Instrument | Classic | Platinum | VIP |

|---|---|---|---|

| US 500 | 0.70 | 0.50 | 0.40 |

| GER 30 | 1.20 | 1.00 | 0.90 |

| US Tech 100 | 1.00 | 0.70 | 0.50 |

| US 30 | 3.00 | 2.00 | 2.00 |

| UK 100 | 1.00 | 0.90 | 0.85 |

| Exchange | Classic | Platinum | VIP |

|---|---|---|---|

| North America | |||

| NASDAQ | 0.02 USD/share (min 10 USD) | 0.015 USD/share (min 7 USD) | 0.01 USD/share (min 3 USD) |

| New York Stock Exchange | 0.02 USD/share (min 10 USD) | 0.015 USD/share (min 7 USD) | 0.01 USD/share (min 3 USD) |

| NYSE MKT | 0.02 USD/share (min 10 USD) | 0.015 USD/share (min 7 USD) | 0.01 USD/share (min 3 USD) |

| Toronto Stock Exchange | 0.03 CAD/share (min 20 CAD) | 0.02 CAD/share (min 15 CAD) (*) | 0.015 CAD/share (min 10 CAD) (*) |

| TSX Venture Exchange | 0.03 CAD/share (min 20 CAD) | 0.02 CAD/share (min 15 CAD)(*) | 0.015 CAD/share (min 10 CAD) (*) |

| Europe / Middle East / Africa | |||

| Athens Exchange | 0.35% (min 12 EUR) | 0.30% (min 12 EUR) | 0.30% (min 12 EUR) |

| BME Spanish Exchanges | 0.10% (min 12 EUR) | 0.08% (min 10 EUR) | 0.06% (min 8 EUR) |

| Deutsche Börse (XETRA) | 0.10% (min 10 EUR) | 0.07% (min 8 EUR) | 0.05% (min 6 EUR) |

| Irish Stock Exchange | 0.10% (min 12 EUR) | 0.09% (min 10 EUR) | 0.08% (min 9 EUR) |

| Johannesburg Stock Exchange | 0.25% (min. 100 ZAR) | 0.20% (min. 90 ZAR) | 0.15% (min. 90 ZAR) |

| London Stock Exchange | 0.10% (min 8 GBP) | 0.07% (min 7 GBP) | 0.05% (min 5 GBP) |

| London Stock Exchange (IOB) | 0.10% (min 20 USD) | 0.08% (min 15 USD) | 0.06% (min 12 USD) |

| Milan Stock Exchange | 0.10% (min 12 EUR) | 0.08% (min 10 EUR) | 0.06% (min 8 EUR) |

| NASDAQ OMX Copenhagen | 0.10% (min 65 DKK) | 0.07% (min 50 DKK) | 0.05% (min 50 DKK) |

| NASDAQ OMX Helsinki | 0.10% (min 12 EUR) | 0.07% (min 10 EUR) | 0.05% (min 8 EUR) |

| NASDAQ OMX Stockholm | 0.10% (min 65 SEK) | 0.07% (min 50 SEK) | 0.05% (min 50 SEK) |

| NYSE Euronext Amsterdam (AEX) | 0.10% (min 12 EUR) | 0.08% (min 10 EUR) | 0.06% (min 8 EUR) |

| NYSE Euronext Brussels | 0.10% (min 12 EUR) | 0.08% (min 10 EUR) | 0.06% (min 8 EUR) |

| NYSE Euronext Lisbon | 0.10% (min 12 EUR) | 0.08% (min 10 EUR) | 0.06% (min 8 EUR) |

| NYSE Euronext Paris | 0.10% (min 10 EUR) | 0.07% (min 8 EUR) | 0.05% (min 6 EUR) |

| Oslo Stock Exchange | 0.10% (min 65 NOK) | 0.08% (min 50 NOK) | 0.06% (min 50 NOK) |

| Prague Stock Exchange | 0.28% (min 500 CZK) | 0.25% (min 350 CZK) | 0.25% (min 350 CZK) |

| SIX Swiss Exchange | 0.10% (min 18 CHF) | 0.08% (min 15 CHF) | 0.06% (min 10 CHF) |

| Vienna Stock Exchange | 0.10% (min 12 EUR) | 0.08% (min 10 EUR) | 0.07% (min 8 EUR) |

| Warsaw Stock Exchange | 0.30% (min 75 PLN) | 0.25% (min 65 PLN) | 0.20% (min 65 PLN) |

| Asia / Pacific | |||

| Australian Securities Exchange | 0.10% (min 8 AUD) | 0.07% (min 8 AUD) | 0.05% (min 8 AUD) |

| Hong Kong Exchanges | 0.15% (min 100 HKD) | 0.12% (min 80 HKD) | 0.10% (min 60 HKD) |

| HK Stock Connect (Shanghai/Shenzhen) | 0.15% (min 40 CNH) | 0.10% (min 30 CNH) | 0.08% (min 20 CNH) |

| Singapore Exchange | 0.15% (min 25 SGD) | 0.12% (min 20 SGD) | 0.10% (min 15 SGD) |

| Tokyo Stock Exchange | 0.15% (min 1,500 JPY) | 0.12% (min 1,000 JPY) | 0.10% (min 1,000 JPY) |

| Commodity | Classic | Platinum | VIP |

|---|---|---|---|

| XAU USD | 14.0 | 12.0 | 11.0 |

| XAU EUR | 15.0 | 13.0 | 12.0 |

| CFD – Gold | 0.60 | 0.55 | 0.50 |

| CFD – Silver | 3.50 | 3.00 | 2.50 |

| Futures - Gold | 6 USD | 3 USD | 1.25 USD |

| Futures - Silver | 6 USD | 3 USD | 1.25 USD |

| Contract Option - Gold | 6 USD | 3 USD | 1.2 5USD |

| Physical Gold ETC (XETRA) | 0.10% (min. 10 EUR) | 0.07% (min. 8 EUR) | 0.05% (min. 6 EUR) |

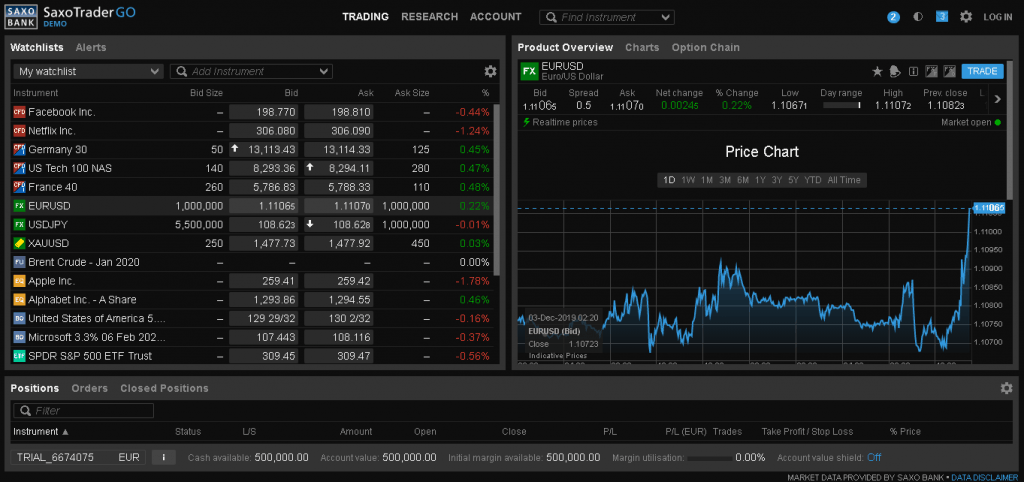

Saxo Bank offers two own trading platforms - SaxoTraderGo and SaxoTraderPro.

The SaxoTraderGo platform is designed for mobile devices. It is minimalistic quick and easy to use. Even in that small mobile display, it manages to give the traders the ability to use good chart analysis by giving them the advanced chart. There are is also access to the news and experts research.

SaxoTraderPro is the desktop Windows/MAC version. You can set up an advanced workspace with 6 monitors. There is advanced trade ticket option for faster orders, advanced charting. There is also an advanced option chain which gives you access to options trading. There is also one unique for the forex market feature - the algorithmic orders. These are orders that activate on conditions and they send to the server. This means that your orders will be executed without the need of having your computer running with no interruptions on the internet.

In conclusion, we can say that SAXO BANK is one solid, reliable bank that offers retail forex. It offers very good trading conditions which can get better and better with the amount of money you wish to invest. The minimal deposit may look big, but it is definitely worthy.

Miroslav Georgiev is Senior Risk Executive with 20+ years of professional wide-ranging experience in multinational forex companies. Take part in Global setup and development of Forex and CFD being an active part of the Business Team. Build and manage Risk management departments and teams.

Looking for an independent and professional Forex brokers review? Our researches will help you find a broker supporting all financial instruments you may need. It will also help you choose the best trading platform for your manual or automated trading.

Disclaimer: Trading Forex (foreign exchange) or CFDs (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. Please note that FxBrokersRanking.com do not provide any kind of financial advices or recommendations.

Advertiser Disclosure: FxBrokersRanking.com is free for everyone, but earns a commission from some of the brokers. We get a commission, with no additional cost to you.