Plus500 is one of the leading providers of CFD trading. The company is listed on London Stock Exchange’s Main Market for Listed Companies and is headquartered in Haifa. Plus500 was founded in 2008 in Israel. The company is the main sponsor of the football team Atlético de Madrid since 2015. Plus500 Ltd is listed on London Stock Exchange’s Main Market for Listed Companies.

| Open Account | Support | Withdrawal | Deposit | Execution | Spread | Overal rating |

|---|---|---|---|---|---|---|

Plus500 serves its client in six regulatory jurisdictions. The Cyprus Securities and Exchange Commission with License No. 250/14 regulates Plus500CY Ltd. Plus500UK Ltd is authorized and regulated by the Financial Conduct Authority with license number FRN 509909. Three regulators regulate Plus500AU Pty Ltd: ASIC (Australian Securities and Investments Commission), FMA in New Zealand, and FSCA in South Africa. Plus500SG Pte Ltd holds a capital markets services license from the Monetary Authority of Singapore for dealing in capital markets products.

The company generally offers one set of standard conditions for its clients. Professional clients could receive improved conditions, especially in terms of leverage. For the CFDs based on forex and indices, the professional trades could receive leverage up to 300:1. The leverage for retail clients is capped to 30:1 according to ESMA guidelines.

Most of the financial services of the company are free. The spreads (the difference between Bid (the price at which you can sell) and Ask (the price at which you can buy)) are competitive. There are also some additional fees that are good to know before starting to trade with this broker. SWAPs (overnight charge to keep the position open in the next day) are average for the industry. There is also a currency conversion fee (fee to convert every profit different from the account currency), a guaranteed Stop Order fee, and an Inactivity fee. You will be charged 10 USD per month if you do not log in to your account for more than three months.

Plus500 offers more than 50 Forex CFDs at competitive spreads. The clients of the company could also trade over 30 Index CFDs including also Crypto10 CFD, which represents the top 10 cryptocurrencies. The offered trading instruments include also a big variety of single stock CFDs, cryptocurrencies CFDs, commodities CFDs, ETF CFDs, and options CFDs.

The list of Cryptocurrency CFDs includes the most traded cryptocurrencies – Bitcoin, Ripple, Ethereum, Litecoin, and more speculative ones like NEO, IOTA, Stellar, Cardano, Tron, Monero, and others. This kind of CFDs is available 24 hours a day, 7 days a week. You could take both sidelong or short and realize profits even in case the market goes down.

Plus 500 offers over 70 forex CFDs including all most major, minor, and exotic pairs, but also US Dollar index.

The list of indices includes the main stock country indices and VIX Volatility Index, Cannabis Stock Index, Real Estate Giants Index, NYSE FANG+ Index, Lithium & Battery Index, and others.

In Plus500’s commodities list the clients could find the most known like Oil, Gold, Natural Gas, Brent Oil, and Wheat, but also more exotic ones like Lean Hogs, Feeder Cattle and Live Cattle.

Plus 500 offers a Guaranteed Stop Order feature. This feature is not available for all instruments and the clients who choose it are subject to wider spreads. The guaranteed Stop orders are subject to some additional restrictions. This type of order could be attached only to a new open order and not to already opened orders. The order can be modified only during the trading time of the instrument. In addition, once placed, the guaranteed Stop order can’t be removed, just changed. Another important restriction is that there is a forbidden zone around the current market price, and the Guaranteed Stop Order must be placed at a certain distance from the market price.

Plus500 charge his clients with a 10 USD inactivity fee, in case they haven’t logged in to their accounts in the last three months.

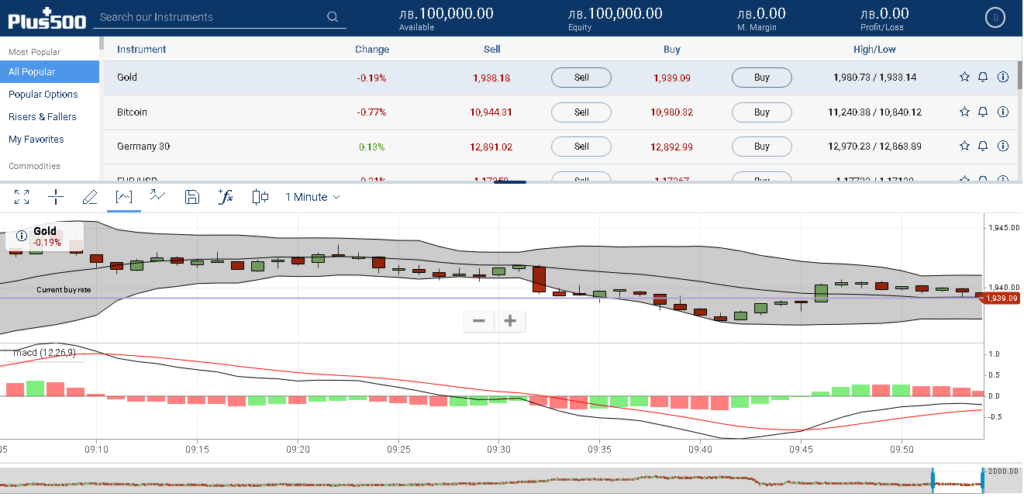

The company serves its clients through a developed in-house trading platform. The clients trade mainly in web and mobile versions of the platform. The platform is one of the highest-rated FD trading platforms in Google Play and Apply’s App store. The platform includes a Risk management module and a big amount of trading indicators and with them, you could improve your trading. The beginning traders always should start at a demo environment to test the platform before going live.

Overall Plus500 provides high quality for trading with a big number of trading instruments. The company is regulated by the biggest and strongest regulators in the world, which provides high defense for clients’ funds. Maybe the biggest disadvantage of the company is that they do not offer the most used retail trader platform MetaTrader. But if you could live without Meta Trader, this broker could be your choice.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Miroslav Georgiev is Senior Risk Executive with 20+ years of professional wide-ranging experience in multinational forex companies. Take part in Global setup and development of Forex and CFD being an active part of the Business Team. Build and manage Risk management departments and teams.

Looking for an independent and professional Forex brokers review? Our researches will help you find a broker supporting all financial instruments you may need. It will also help you choose the best trading platform for your manual or automated trading.

Disclaimer: Trading Forex (foreign exchange) or CFDs (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. Please note that FxBrokersRanking.com do not provide any kind of financial advices or recommendations.

Advertiser Disclosure: FxBrokersRanking.com is free for everyone, but earns a commission from some of the brokers. We get a commission, with no additional cost to you.